This piece was originally published in the April 4, 2022 edition of CAP Action’s newsletter, the Progress Report. Subscribe to the Progress Report here.

“You shouldn’t be able to avoid income taxes just because your wealth lives in a portfolio instead of in your house. We need a way to make sure billionaires pay at least a 20 percent income tax—that’s what the Billionaire Income Tax does.” – Rep. Ro Khanna (D-CA)

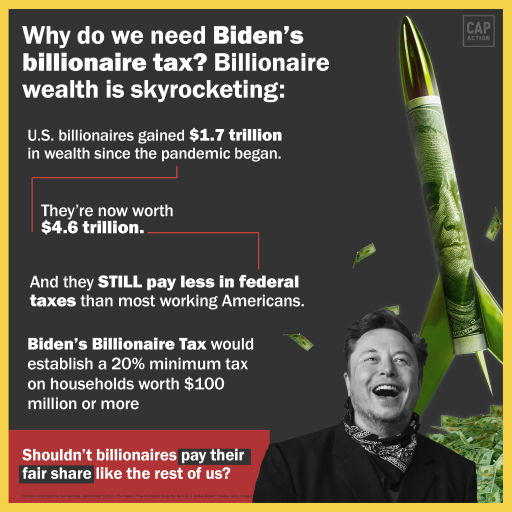

Over the course of this pandemic, American billionaires have gained $1.7 trillion, bringing their total net worth to $4.6 trillion.

Despite this incredible wealth, billionaires pay on average an effective tax rate of 8.2 percent. That’s less than what many middle-class American workers such as teachers, nurses, and firefighters pay.

President Joe Biden has a plan to make this right. His proposal would ensure that the ultrarich pay their fair share in taxes—and it would establish a minimum tax rate of 20 percent on households worth more than $100 million. According to the White House, this tax would reduce the deficit by $360 billion over the next decade. It’s time for billionaires to pay their fair share.

Share this graphic to show your support for Biden’s billionaire tax:

- The Senate is projected to vote this week on Judge Ketanji Brown Jackson’s confirmation to the Supreme Court. Despite a likely tie in the Senate Judiciary Committee, Senate Democrats are set to confirm Judge Jackson by using a discharge petition to bring her confirmation to the full Senate.

- The Intergovernmental Panel on Climate Change (IPCC) released its latest report on Monday morning. IPCC scientists have recommended large-scale movements away from the use of fossil fuels over the next eight years. Lead author Heleen De Coninck says it is the point of “now or never” to limit climate warming.

What we’re reading

This piece was originally published in the April 4, 2022 edition of CAP Action’s newsletter, the Progress Report. Subscribe to the Progress Report here.