This piece was originally published in the April 27, 2022 edition of CAP Action’s newsletter, the Progress Report. Subscribe to the Progress Report here.

“Corporate profits hit record highs last year. There’s no excuse for some of the largest corporations in this country to be paying less than 0% in federal income tax while their CEOs make tens of millions of dollars.” – Rep. Pramila Jayapal (D-WA)

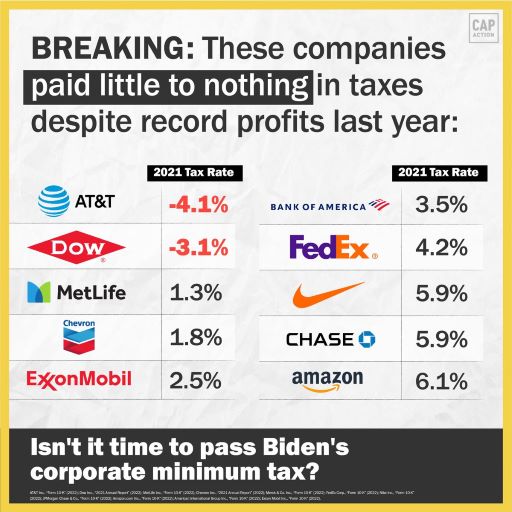

Two weeks ago, millions of Americans paid their 2021 federal income taxes. Yet many of America’s largest companies didn’t pay a dime. Some of these big, profitable businesses will actually receive a tax refund.

Corporate greed is hurting Americans every time they pay for necessities such as gas, food, and clothing. This greed must be reined in with policies that make the U.S. economy work for all Americans, not just big corporations and the rich.

The current corporate tax rate is 21 percent, many of the nation’s biggest and most profitable companies pay far less than that. President Joe Biden plans to prevent corporations from using loopholes in the tax code to pay anything less than 15 percent. It’s more than fair to corporations, and it’s fair to taxpayers.

Share the graphic below to let your followers know the facts:

- Florida Gov. Ron DeSantis (R) signed into law a bill creating one of the nation’s only police forces tasked with investigating election fraud. The measure is a reaction to the big lie of Donald Trump’s faction that the 2020 presidential election was “stolen.”

- President Biden marked Second Chance Month on Tuesday by commuting the sentences of 75 people in prison for nonviolent offenses and issuing full pardons to three more, stating:”America is a nation of laws and second chances, redemption, and rehabilitation. Elected officials on both sides of the aisle, faith leaders, civil rights advocates, and law enforcement leaders agree that our criminal justice system can and should reflect these core values that enable safer and stronger communities.”

What we’re reading

This piece was originally published in the April 27, 2022 edition of CAP Action’s newsletter, the Progress Report. Subscribe to the Progress Report here.